THE KOREA FUND, INC.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULERule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENTProxy Statement Pursuant to Section 14(a) of the

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OFSecurities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting | |

THE KOREA FUND, INC.

(Name of Registrant as Specified in its Charter)

1633 Broadway

New York, New York 10019

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and | |||

Amount Previously Paid:

| ||||

Form, Schedule or Registration Statement No.:

| ||||

Filing Party:

| ||||

Date Filed:

| ||||

|

THE KOREA FUND, INC. |

Dear Fellow Stockholders:

The Annual MeetingOn behalf of Stockholders (the “Annual Meeting”)the Board of Directors of The Korea Fund, Inc., (the “Board”) a Maryland corporation (the “Fund”) is, we are pleased to invite you to the special meeting (the “Meeting”) of the Stockholders of the Fund to be held telephonically via conference call on Friday, December 11, 2020 at 10:309:00 a.m., Eastern time, on Friday, October 26, 2018, attime.

On August 28, 2020, the officesFund announced that it is pursuing arrangements with JPMorgan Asset Management (Asia Pacific) Limited (“JPMorgan Asia”) to serve as investment adviser of Allianz Global Investorsthe Fund and with affiliates of JPMorgan Asia (including JP Morgan Chase Bank, N.A. and JPMorgan Funds Limited), to serve as administrator and custodian of the Fund. This follows a search process conducted by the Board in light of AllianzGI U.S. LLC, 1633 Broadway, between West 50th’s decision to transition away from the business of serving as sponsor/administrator of U.S. registered open- and West 51closed-end funds. The change would result in the transition of the Fund’s stday-to-day Streets, 42nd Floor, New York, New York 10019. Stockholders who are unable portfolio management, administration, fund accounting, custody and other services to attend the Annual Meeting are strongly encouraged to vote by proxy, which is customary in corporate meetings of this kind. A Proxy Statement regarding the Annual Meeting, a proxy card for your vote at the Annual Meeting,JPMorgan Asia and an envelope – postage-prepaid – in which to return your proxy card are enclosed. You may also vote through the Internet or by telephone by following the instructions on the enclosed proxy card.its affiliates.

At the Annualupcoming special Meeting, your BoardStockholders will be seeking your supportasked to consider and vote with respect to a proposed new investment advisory agreement between the Fund and JPMorgan Asia. After consideration, the Board believes that JPMorgan Asia and its affiliates have the experience, capabilities and resources to provide qualify investment management and other services required for the re-electday-to-day one Class III Director, Richard A. Silver (the “Proposal”). Youroperations of the Fund. The Board has three classes of Directors, each class servingunanimously approved this proposal for a three-year term. Your Board has carefully considered the ProposalFund and recommends that each Stockholder vote FOR the proposal.

Thank you vote in favor of the nomineeadvance for Class III Director.

Your Board looks forward to meeting stockholders at the Annual Meeting, at which time we shall be available to discuss any issues of interest to you with regard to our Fund.your participation in this important vote.

Yours very sincerely,

Julian ReidRead

Chairman of the Board

November [●], 2020

STOCKHOLDERS ARE URGED TO SIGN AND DATE THE ENCLOSED PROXY CARD AND MAIL IT IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE, OR TO VOTE THROUGH THE INTERNET OR BY TELEPHONE, SO AS TO ENSURE A QUORUM AT THE MEETING. THIS IS IMPORTANT WHETHER YOU OWN FEW OR MANY SHARES.

Both the Board and AllianzGI U.S. are sensitive to the health and travel concerns of the Fund’s Stockholders and the evolving recommendations from public health officials. Due to the difficulties arising from COVID-19, the Meeting will be conducted telephonically. Any Stockholder wishing to participate in the Meeting by means of remote communication can do so. If you were a record holder of Fund shares as of October 29, 2020, please e-mail AST Fund Solutions, LLC (“AST”) at attendameeting@astfinancial.com no later than 3:00 p.m. Eastern Time on [●], 2020 to register. Please include the Fund’s name in the subject line and provide your name and address in the body of the e-mail. AST will then e-mail you the meeting login information and instructions for voting during the Meeting. If you held Fund shares through an intermediary, such as a broker-dealer, as of October 29, 2020, and you want to participate in the Meeting, please e-mail AST at attendameeting@astfinancial.com no later than 3:00 p.m. Eastern Time on [●], 2020 to register. Please include your Fund’s name in the subject line and provide your name, address and proof of ownership as of October 29, 2020 from your intermediary. Please be aware that if you wish to vote at the Meeting you must first obtain a legal proxy from your intermediary reflecting the Fund’s name, the number of Fund shares you held and your name and e-mail address. You may forward an e-mail from your intermediary containing the legal proxy or attach an image of the legal proxy via e-mail to AST at attendameeting@astfinancial.com and put “Legal Proxy” in the subject line. AST will then e-mail you the conference call dial-in information and instructions for voting during the Meeting.

In light of uncertainties relating to COVID-19, the Fund reserves the flexibility to change the date, time, location or means of conducting the Meeting. In the event of such a change, the Fund will issue a press release announcing the change and file the announcement on the SEC’s EDGAR system, among other steps, but may not deliver additional soliciting materials to Stockholders or otherwise amend the Fund’s proxy materials. Although no decision has been made, the Fund may consider imposing additional procedures or limitations on Meeting attendees, subject to any restrictions imposed by applicable law. The Fund plans to announce these changes, if any, at https://www.thekoreafund.com/, and encourages you to check this website prior to the Meeting.

THE KOREA FUND, INC.

Notice of Annual Meeting of Stockholders1633 Broadway

New York, NY 10019

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 11, 2020

To the Stockholders of

The Korea Fund, Inc.:

Please take noticeNotice is hereby given that the AnnualSpecial Meeting of Stockholders (the “Meeting”) of The Korea Fund, Inc., (the “Fund”) is scheduled for Friday, December 11, 2020 at 9:00 a.m., Eastern time, to be held telephonically via conference call.

As described in the Proxy Statement, the Meeting has been called to be held atfor the officesfollowing purpose:

1. To approve a new investment advisory agreement between the Fund and JPMorgan Asset Management (Asia Pacific) Limited, as described in Section I of Allianz Global Investors U.S. LLC, 1633 Broadway, between West 50ththe attached Proxy Statement; and West 51st Streets, 42nd Floor, New York, New York 10019, on Friday, October 26, 2018 at 10:30 a.m., Eastern time,

|

|

The Board of Directors of the Fund unanimously recommends that you vote FOR Proposal 1 specified above.

The Boards of Directors of the Fund has fixed the close of business on August 24, 2018October 29, 2020 as the record date for the determination of stockholdersStockholders entitled to notice of, and to vote at, the Meeting or any postponementadjournment or adjournmentpostponement thereof. The enclosed proxy is being solicited on behalf of the Board of Directors.Directors of the Fund.

| By order of the |

|

Angela Borreggine Secretary and Chief Legal Officer |

New York, New York

September 7, 2018November [●], 2020

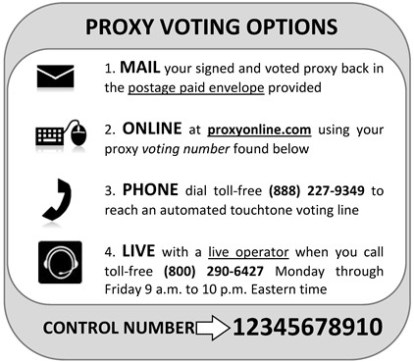

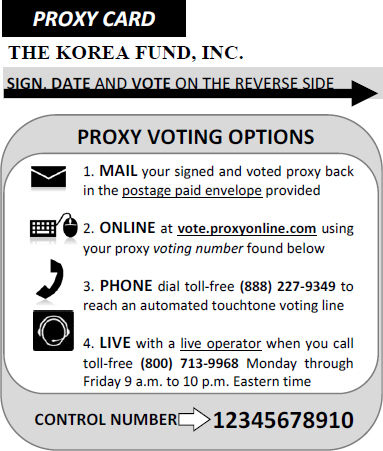

It is important that your shares be represented at the Meeting in person or by proxy, no matter how many shares you own. If you do not expect to attend the Meeting, then please complete, date, sign and returngive your voting instructions by telephone or via the applicable enclosed proxy or proxies ininternet by following the accompanying envelope, which requires no postage if mailed in the United States, or vote through the Internet or by telephone. Please mark and mailinstructions on your proxy card, or, proxies,if you wish to vote by mail, you may vote by completing, signing, dating and returning your proxy card. Please give your voting instructions or vote through the Internet or by telephone,submit your proxy card promptly in order to save the Fundavoid any additional costs of further proxy solicitations and in order for the Meeting to be held as scheduled.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON DECEMBER 11, 2020

PROXY STATEMENT

GENERAL

ThisThe Proxy Statement and the accompanying Notice of Special Meeting of Stockholders are available without charge by following the instructions on your Notice of Internet Availability of Proxy Materials. In addition, Stockholders can find important information about the Fund in its annual shareholder report, dated August 28, 2020, including financial reports for the fiscal year ended June 30, 2020. Upon request and without charge, the Fund will furnish each person to whom the Notice of Internet Availability of Proxy Materials or the Proxy Statement is furnished in connectiondelivered with a copy of these reports. You may obtain copies of these reports without charge by visiting www.thekoreafund.com, or by calling the solicitation of proxies byFund’s stockholder servicing agent at (800) 254-5197 or writing the Fund at 1633 Broadway, New York, New York 10019.

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 15 | ||||

| 17 | ||||

| A-1 | ||||

1

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 11, 2020

THE KOREA FUND, INC.

1633 Broadway

New York, NY 10019

The Board of Directors (the “Board” or “Directors”) of The Korea Fund, Inc., (the “Board of Directors” or the “Board”) a Maryland corporation (the “Fund”), for use atis soliciting proxies from the Annual Meetingholders of common stock of the Fund (the “Stockholders”) in connection with the special meeting of Stockholders to be held at the offices Allianz Global Investors U.S. LLC (“AllianzGI U.S.”), 1633 Broadway between West 50th and West 51st Streets, 42nd Floor, New York, New York 10019,telephonically via conference call on Friday, October 26, 2018December 11, 2020 beginning at 10:309:00 a.m., Eastern time (the “Meeting”), and at any adjournments or postponements thereof.

This Proxy Statement, the Notice of Annual Meeting of Stockholders, and the proxy card are first being mailed to stockholders on or about September 14, 2018 or as soon as practicable thereafter.

The Board has fixed the close of business on August 24, 2018October 29, 2020 as the record date (the “Record Date”) for the determination of stockholders of the Fund entitled to notice of, and to vote at, the Meeting and any postponement or adjournment thereof. Stockholders on the Record Date will be entitled to one vote for each full share and a proportionate fraction of a vote for each fractional share held, with no cumulative voting rights, with respect to each matter on which they are entitled to vote. As of the Record Date, there were 5,346,415[5,034,820] shares of common stock of the Fund outstanding (the “Shares”).

As has previously been reported, the Fund’s current investment manager, Allianz Global Investors U.S. LLC (“AllianzGI U.S.”), has determined to transition away from the business of serving as sponsor/administrator of U.S. registered open- and closed-end funds. On August 28, 2020, the Fund announced that it had conducted a search process and has determined to pursue arrangements with JPMorgan Asset Management (Asia Pacific) Limited (“JPMorgan Asia”) to serve as investment adviser of the Fund and with affiliates of JPMorgan Asia (including JP Morgan Chase Bank, N.A. and JPMorgan Funds Limited) to serve as administrator and custodian of the Fund (the “Transition”).

The Board has unanimously approved a proposed investment advisory agreement with JPMorgan Asia (the “Proposed Investment Advisory Agreement”) and proposed administrative, custody and other agreements with affiliates of JPMorgan Asia (together, “JPMorgan”), and recommends the Proposed Investment Advisory Agreement for approval by the Fund’s Stockholders. The Board believes that JPMorgan has the experience, capabilities and resources to provide qualify investment management and other services required for the day-to-day operations of the Fund. Among other considerations, the Board took into account that JPMorgan has agreed to provide such services to the Fund at fee and expense levels that are estimated to be somewhat lower than the Fund’s current fee and expense levels.

Subject to approval by Stockholders, the Transition is currently scheduled to take place on or about January 1, 2021, the date upon which the Fund’s current investment management agreement with AllianzGI U.S. is scheduled to terminate. If Stockholders do not approve the Proposed Investment Advisory Agreement, the Directors will take such further action as they deem to be in the best interests of the Fund and Stockholders.

The Notice of Special Meeting of Stockholders, this Proxy Statement and the proxy card are being made available to Stockholders of record as of the Record Date beginning on or about November [●], 2020 or as soon as practicable thereafter.

1

If the enclosed proxy is executed and returned, that vote may nevertheless be revoked at any time prior to its use by written notification received by the Fund (addressed to the Fund’s Secretary at the Fund’s principal executive offices, 1633 Broadway, New York, New York 10019), by the execution of a later-dated proxy, by the Fund’s receipt of a subsequent valid Internet or telephone vote, or by attending the Meeting and voting in person.virtually. Proxies voted through the Internet or by telephone may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked. Please note that merely virtually attending the Meeting without voting will not revoke a valid proxy.

All properly executed proxies received in time for the Meeting (as explained on the enclosed proxy card) will be voted as specified in the proxy. Unless instructions to the contrary are marked, proxies will be voted “FOR” the election of Richard A. Silver as a Class III Director (the “Proposal”).

The presence at the Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast thereat shall be necessary and

1

sufficient to constitute a quorum for the transaction of business. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker“non-votes” will be treated as shares that are present, but which have not been voted. Brokernon-votes are proxies received by the Fund from brokers or nominees for which the broker or nominee has neither received instructions from the beneficial owner or other persons entitled to vote, nor discretionary power to vote on a particular matter. Election of the Director nominee requires the affirmative vote of the holders of a majority of Shares present in person or by proxy and entitled to vote thereon. Abstentions and brokernon-votes will have the effect of a vote against the Proposal. Stockholders are urged to forward their voting instructions promptly.

The Fund provides periodic reports to all stockholders, which highlight relevant information, including investment results and a review of portfolio changes. You may receive an additional copy of the Fund’s annual report for its fiscal year ended June 30, 20182020 and a copy of the Fund’s semi-annual report for thesix-month period ended December 31, 2017,2019, without charge, by calling the Fund’s stockholder servicing agent at (800)254-5197 or writing the Fund at 1633 Broadway, New York, New York 10019.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 26, 2018

The 2018 Proxy Statement and the Annual Report to Stockholders for the fiscal year ended June 30, 2018 are available at www.thekoreafund.com.

PROPOSAL: ELECTION OF CLASS III DIRECTOR

The Board of Directors is divided into three classes, with each Director serving for a term of three years. The Class III Director is up for election at the Meeting.

Persons named in the accompanying proxy card intend, in the absence of contrary instructions, to vote all proxies in favor of the election of the nominee listed below as Class III Director of the Fund, to serve for a term of three years and until his successor is duly elected and qualified, or his earlier death, resignation, retirement or removal. The Class III nominee would serve until the 2021 Annual Meeting of Stockholders, until his successor is duly elected and qualified, or his earlier death, resignation, retirement or removal. Mr. Silver is currently the Class III Director who is standing forre-election and has consented

2

As described below, the Meeting has been called for the following purposes:

1. To be voted on by all Stockholders of the Fund: the approval of a Proposed Investment Advisory Agreement between the Fund and JPMorgan Asia, as described in Section I below; and

2. To consider and act upon such other matters as may properly come before the Meeting and any adjourned or postponed session thereof.

The Board knows of no business other than the Proposal set forth herein to stand forre-election and to serve if elected.be considered at the Meeting. If Mr. Silver should be unable to serve, an event not now anticipated,any other business is properly presented before the Meeting, including any adjournment or postponement thereof, the persons named as proxies will be voted for such person, if any, as shall be designated by the Board of Directors to replace the nominee. The Board of Directors has unanimously approved the nomination of Mr. Silver as a Director of the Fund.

Information Concerning the Nomineevote in their sole discretion.

The following table sets forth certain information concerning the nominee for Class III Directorprincipal executive offices of the Fund to serve until the 2021 Annual Meeting of Stockholders.

Name Address* | Position(s) Held with the Fund | Year First Became a Director | Principle Occupation(s) | Number of Portfolios in Fund Complex Overseen by Director/ Nominee | Other Directorships Held by Director/ Nominee | |||||

Richard A. Silver (1947) | Director and Chairman of the Audit and Compliance Committee, Valuation Committee | 2006 | Director of The China Fund, Inc. (since 2018). Former Manager of Silver Oak Land Trusts I, II, III, IV, V and VII, LLCs. | 1 | Director of The China Fund, Inc. |

Information Concerning Continuing Directors

The following tables set forth certain information regarding the Fund’s Class I and Class II Directors. As noted above, these Directors are not up for election this year. Messrs. Reid, Grause and Brader will serve until the applicable stockholder meeting noted below and his successor is elected and has qualified, or his earlier death, resignation, retirement or removal.located at 1633 Broadway, New York, New York 10019.

3

I. APPROVAL OF THE PROPOSED INVESTMENT ADVISORY AGREEMENT

Introduction

AllianzGI U.S., the Fund’s current investment manager, has determined to transition away from the business of serving as sponsor/administrator of U.S. registered open- and Class I — Directors Servingclosed-end funds. Accordingly, the Board conducted a search process and has determined to pursue arrangements with JPMorgan Asia to serve as investment adviser of the Fund and with affiliates of JPMorgan Asia (together with JPMorgan Asia, the “JPMorgan Entities” or “JPMorgan”) to serve as administrator and custodian of the Fund (the “Transition”).

AllianzGI U.S. currently provides or procures the investment advisory and administrative services required by the Fund pursuant to a single investment management agreement (defined below as the Current IMA), and the Fund and/or AllianzGI U.S. retains State Street Bank & Trust Company (“State Street”) to provide custody and fund accounting services to the Fund. In connection with the contemplated Transition, the Board unanimously approved the Proposed Investment Advisory Agreement, pursuant to which JPMorgan Asia would provide the day-to-day portfolio management services required by the Fund. The Board also unanimously approved (i) a new Services Agreement between the Fund and JPMorgan Funds Limited (“JPMFL”), pursuant to which JPMFL would provide or procure compliance, legal, recordkeeping, service provider oversight and other administrative services for the Fund, including the provision of personnel of JPMFL or its affiliates to serve as officers of the Fund, (ii) a new Fund Administrative Services Agreement between the Fund and JPMorgan Chase Bank, N.A. (“JPMorgan Chase”), pursuant to which JPMorgan Chase would provide fund accounting, financial regulatory and reporting, treasury, tax and compliance reporting services for the Fund, and (iii) a new Global Custody Agreement between the Fund and JPMorgan Chase, pursuant to which JPMorgan would serve as custodian and provide related services on behalf of the Fund (together, the “Other JPMorgan Agreements”). Following the Transition, pursuant to the Proposed Investment Advisory Agreement and Other JPMorgan Agreements, the JPMorgan Entities would collectively provide all of the investment advisory and administrative services for the Fund currently provided or procured by AllianzGI U.S. under the Current IMA, and JPMorgan Chase would provide the custody services to the Fund currently provided by State Street in its capacity as the Fund’s current custodian. The fee and expense arrangements under the Other JPMorgan Agreements are discussed below.

Stockholders of the Fund are being asked to approve the Proposed Investment Advisory Agreement with JPMorgan Asia (this Proposal 1) at the upcoming Meeting. Stockholder approval is not required or being sought with respect to the Other JPMorgan Agreements. However, the Other JPMorgan Agreements and related arrangements with JPMorgan will not take effect unless and until the 2019 Annual MeetingProposed Investment Advisory Agreement is approved by Stockholders and takes effect.

Subject to approval by Stockholders, the Transition is currently scheduled to take place on or about January 1, 2020, the date upon which the Fund’s current investment management agreement with AllianzGI U.S. is scheduled to terminate. If Stockholders do not approve the Proposed Investment Advisory Agreement, the Directors will take such further action as they deem to be in the best interests of Stockholdersthe Fund and Stockholders.

Information Regarding the Proposed Investment Adviser – JPMorgan Asia

Name | Position(s) Held with the Fund | Year First Became a Director | Principle Occupation(s) | Number of Portfolios in Fund Complex Overseen by Director/ Nominee | Other Directorships Held by Director/ Nominee | |||||||||

Julian Reid (1944) | Director and Chairman of the Board | 2004 | Director and Chairman of 3a Funds Group (since 1998); and Director of The China Fund, Inc. (since 2018). Formerly, Director and Chairman of JM Properties Ltd. (from 2012 to 2015); Director of JP Morgan China Region Fund, Inc. (from 1997 to 2017); and Director and Chairman of Prosperity Voskhod Fund Ltd. (from 2006 to 2015). | 1 | Director of The China Fund, Inc. | |||||||||

Joseph T. Grause, Jr. (1952) | Director and Chairman of the Governance, Nomination and Remuneration Committee | 2012 | Self Employed Consultant (since January 2012) | 1 | Independent Trustee of the Advisors’ Inner Circle, Advisors’ Inner Circle II, Bishop Street and KP Funds | |||||||||

JPMorgan Asia, together with various affiliated investment advisers and the asset management division of JPMorgan Chase comprise the asset management business of J.P. Morgan Asset & Wealth Management. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. and its affiliates worldwide (“JPMC”). JPMC is a publicly traded global financial services firm. JPMorgan Asia is a wholly-owned subsidiary of JPMorgan Asset Management (Asia) Inc., which is a subsidiary of JPMC.

4

Class II — Director Serving until the 2020 Annual MeetingJPMorgan Asia was incorporated in Hong Kong on November 26, 1974. As of Stockholders

Name Address* and Year of | Position(s) Held with the Fund | Year First Became a Director | Principle Occupation(s) During the Past 5 Years | Number of Portfolios in Fund Complex Overseen by Director/ Nominee | Other Directorships Held by Director/ Nominee | |||||

Christopher B. Brader (1950) | Director | 2012 | Director of Long Investment Management International, Ltd. (since March 2015); Director of LIM Japan Fund (since March 2012); Director of India Capital; Director of Long Investment Management (Cayman) Limited (since 2018); Director of LIM Marketing Services Limited (since 2018) | 1 | None |

|

All Directors are considered by the Fund own securities in or have any other material direct or indirect interests in JPMorgan Asia as of the date of the filing of this Proxy Statement.] JPMorgan Asia does not serve as investment adviser to be “interested persons” (as defined in Section 2(a)(19) ofany investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”))amended.

The names and principal occupations of the Fund and the Fund’s investment manager, Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Manager”).

As of August 24, 2018 the dollar range of equity securities in the Fund owned by each Director or the nominee was as follows:

| ||||

| ||||

| ||||

| ||||

|

|

5

As of August 24, 2018, no officer of the Fund owned shares of the Fund. As of August 24, 2018, all Directors, the nominee and officers of the Fund as a group owned less than 1% of the outstanding shares of the Fund.

Section 16(a) Beneficial Ownership Reporting Compliance The Fund’s Directors and certain officers, investment advisers, certain affiliated persons of the investment advisers and persons who own more than 10% of any class of outstanding securities of the Fund are required to file forms reporting their relationship with the Fund and reports of ownership and changes in ownership of the Fund’s securities with the Securities and Exchange Commission (the “SEC”) and the New York Stock Exchange (the “NYSE”). These persons and entities are required by SEC regulation to furnish the Fund with copies of all such forms they file. Based solely on a review of these forms furnished to the Fund, the Fund believes that each of the Directors and relevant officers, investment advisers and relevant affiliated persons of the investment advisers and the persons who beneficially own more than 10% of the Fund’s Shares has complied with all applicable filing requirements during the Fund’s fiscal year ended June 30, 2018.

As of August 24, 2018, the following stockholders owned beneficially more than 5% of the Fund’s outstanding Shares as reported to the SEC pursuant to Rule13d-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

Common Stock | City of London Investment Group 77 Gracechurch Street London, England | 1,976,240 | 35.37 | % | ||||||

Common Stock | Lazard Ltd, 30 Rockefeller Plaza New York, NY 10012 | 644,947 | 11.54 | % | ||||||

Common Stock | 1607 Capital Partners 13 S. 13th Street, Richmond, VA 23219 | 466,673 | 8.35 | % | ||||||

6

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

Common Stock | Bill & Melinda Gates Foundation Trust 2365 Carillon Point Kirkland, WA 98033 | 330,312 | 5.91 | % | ||||||

|

Except as noted above, to the best of the Fund’s knowledge, as of August 24, 2018 no other person owned beneficially more than 5% of the Fund’s outstanding Shares.

Directors and Officers

The business of the Fund is managed under the direction of the Fund’s Board of Directors. Subject to the provisions of the Fund’s Articles of Incorporation, itsBy-laws and Maryland law, the Directors have all powers necessary and convenient to carry out this responsibility, including the election and removal of the Fund’s officers.

Board Leadership Structure— The Fund’s Board of Directors consists of four Directors, none of whom are “interested persons” (within the meaning of Section 2(a)(19) of the 1940 Act) of the Fund or of the Manager (the “Independent Directors”). An Independent Director serves as Chairman of the Board and is selected by vote of the majority of the Independent Directors. The Chairman of the Board presides at meetings of the Board and acts as a liaison with service providers, officers, attorneys and other Directors generally between meetings, and performs such other functions as may be requested by the Board from time to time.

The Board meets regularly four times each year to discuss and to consider matters concerning the Fund, and also holds special meetings as necessary to address matters arising between regular meetings. The Independent Directors regularly meet outside the presence of Fund management.

The Board has established seven standing Committees to facilitate the Directors’ oversight of the management of the Fund: the Audit and Compliance Committee, the Contracts Committee, the Executive Committee, the Governance, Nominating and Remuneration Committee, the Investment Committee, the Discount Management Committee and the Valuation Committee.

7

The functions and role of each Committee are described below under “— Committees of the Board of Directors.” The membership of each Committee consists of all of the Independent Directors, which the Directors believe allows them to participate in the full range of the Board’s oversight duties.

The Board reviews its leadership structure periodically and has determined that this leadership structure, including an independent chairman, a Board composed solely of Independent Directors and full Independent Director membership on each Committee, is appropriate in light of the characteristics and circumstances of the Fund. In reaching this conclusion, the Board considered, among other things, the predominant role of the Manager in theday-to-day management of Fund affairs, the extent to which the work of the Board is conducted through the Committees, the net assets of the Fund and the management, administrative and other service arrangements of the Fund. The Board also believes that its structure, including the active role of the Independent Directors, facilitates an efficient flow of information concerning the management of the Fund to the Independent Directors.

Risk Oversight— The Fund has retained the Manager to provide administrative services. The Manager is immediately responsible for the management of risks that may arise from Fund investments and operations. Some employees of the Manager serve as officers of the Fund, including the Fund’s principal executive officer and principal financial and accounting officer. The Board oversees the performance of those functions by the Manager, both directly and through the Committee structure it has established. The Board receives from the Manager a wide range of reports, on both a regular basis and anas-needed basis, relating to the Fund’s activities and to the actual and potential risks of the Fund. These include, among others, reports on investment risks, compliance with applicable laws and the Fund’s financial accounting and reporting. In addition, the Board meets periodically with the portfolio managers of the Fund to receive reports regarding the portfolio management of the Fund and its performance, including its investment risks, and the Korean market in general.

In addition, the Board has appointed a Chief Compliance Officer (“CCO”). The CCO oversees the development of compliance policies and procedures that are reasonably designed to minimize the risk of violations of the federal securities laws (“Compliance Policies”). The CCO reports directly to the Independent Directors, and the CCO or a member of his team provides presentations to the Board at its quarterly meetings and an annual report on the application of the Compliance Policies. The Board periodically discusses relevant risks affecting the Fund with the CCO at these meetings. The Board has approved the Compliance Policies and reviews the CCO’s reports. Further, the

8

Board annually reviews the sufficiency of the Compliance Policies, as well as the appointment and compensation of the CCO.

Executive and Other Officers of the Fund.The table below provides certain information concerning the executive officers of the FundJPMorgan Asia and certain other officers who perform similar duties. Officers hold office at the pleasureits parent entities are set forth below. The address of the Board and until their successors are appointed and qualified or until their earlier resignation or removal. Officers and employees of the Fund who are principals, officers, members or employees of the Manager or its affiliates are not compensated by the Fund.each is c/o JPMorgan Asset Management (Asia Pacific) Limited,Charter House, 8 Connaught Road, 21st Floor, Hong Kong.

| Principal Occupation: | Years in the Industry: | ||||||||

Ayaz Hatim Ebrahim |

| |||||||||

| ||||||||||

| Managing Director | [●] | [●] | |||||||

Shaw Yann Ho | Managing Director | [●] | [●] | |||||||

Muriel Yerk Kwan Sung | Chief | [●] | [●] | |||||||

Chloe Louise Thomas | Managing Director | [●] | [●] | |||||||

Daniel James Watkins | Managing Director | [●] | [●] | |||||||

The Fund will be managed by JPMorgan Asia’s Korea investment team, John Cho and Seol Kim, who are part of JPMorgan’s Emerging Markets and Asia Pacific (“EMAP”) Equities team[, which is led by Ayaz Ebrahim,] and they are supported by the product and sector analysts within the wider team. JPMorgan Asia has a strong team-orientated investment approach, with portfolio managers and research analysts across the group participating fully in the investment process.

John Cho, executive director, is a country specialist for Korean equities within the EMAP Equities team based in Hong Kong. He joined the firm in 2007 and transferred to Hong Kong from Seoul to take up his current role in 2011. Prior to that, he worked as a Korea equity sales for seven years, with his last position at Woori Investment & Securities. John obtained a M.Sc. in International Securities, Investment and Banking from the University of Reading in the U.K. and an M.A. in Business Economics from Wilfrid Laurier University in Canada.

Ayaz Ebrahim, managing director, is a portfolio manager and the co-head of the Asia Pacific Regional team within the EMAP Equities team based in Hong Kong. He also chairs the Asia Pacific Asset Allocation Committee. Before joining JPMAM in September 2015, Ayaz was previously with Amundi Hong Kong where he spent more than five years as the CIO of Asia ex-Japan equities and Deputy Chief Executive Officer (CEO). Prior to that Ayaz was the CIO, Asia Pacific, for both HSBC Global Asset Management and Deutsche Asset Management. From 1991 to 2002, he worked at Crédit Agricole Asset Management Hong Kong (now named Amundi Hong Kong Limited), initially as an investment manager and subsequently as CIO for Asia. Ayaz holds a Doctorate degree in Civil Law (DCL) and a Bachelor of Science degree (Honours) in Accountancy from the University of East Anglia in the U.K.

Seol Kim, vice president, is a country specialist for Korean equities within the EMAP Equities team based in Seoul. Seol joined the firm in 2016 from BNP Paribas where she was a Korean Equity Sales. Prior to that, she was a research analyst with KB Asset Management for 5 years. She also worked as an investment analyst with UBS and JPMorgan. Seol started her career with Samsung SDS in 2003 and obtained a BSc. in Mathematics and Economics from London School of Economics.

95

Information Regarding the Other JPMorgan Entities

Pursuant to the Other JPMorgan Agreements described above, JPMFL would serve as the administrator of the Fund and JPMorgan Chase would serve as the custodian. JPMFL is a UK-based affiliate of JPMorgan Asia and, if the Transition as described above is consummated, is expected to request that the Board approve the following individuals as officers of the Fund.

President and Chief Executive Officer – Simon Crinage

Simon Crinage, managing director, is Head of J.P. Morgan Asset Management’s closed-end fund business. Until its liquidation in 2017, Simon was both a Director and President of JPMorgan China Region Fund, Inc. (NYSE: JFC) and between 2014 and 2019 President of The Taiwan Fund Inc. (NYSE: TWN). An employee since 1984, Simon has over 30 years closed-end fund experience. He spent much of the 1990’s with Jardine Fleming in Asia, working in Hong Kong, Japan and Malaysia, where he had responsibility for developing their mutual fund businesses in those countries.

Chief Financial Officer/Treasurer – Neil Martin

Neil Martin, executive director, is Head of the UK Client Service Board Management, UK Product Administration & Oversight. Neil is responsible for provision of company secretarial services to the JPMorgan UK & Luxembourg Fund range and the Product administration and Oversight for the JPMorgan UK fund range only. This includes daily NAV oversight, financial statement production, client reporting, vendor management and certain regulatory responsibilities. Neil was the Treasurer of JPMorgan China Region Fund, Inc. (NYSE: JFC) from 2014 until its liquidation in 2017.

Secretary – Paul Winship

Paul Winship, vice president, is a company secretary in J.P. Morgan Asset Management’s investment trust business. Since joining JPMorgan in early 2014 he has worked with JPMorgan European Investment Trust plc, JPMorgan Russian Securities plc, JPMorgan Multi-Asset Trust plc and The Taiwan Fund, Inc. Paul began his training as a company secretary with Trafalgar House plc in London and over the past 10 years has been a company secretary for corporate trust companies in the City of London and most recently for the Aga Khan Fund for Economic Development in Paris. He has an LLB (Hons) in Law and is an Associate of the Chartered Governance Institute (previously known as the Institute of Chartered Secretaries and Administrators) and also of the Association of Taxation Technicians.

Chief Compliance Officer – Stephen Ungerman

Stephen Ungerman, managing director, is the Chief Compliance Officer of the JPMorgan Funds. An employee since 2000, he previously managed the Funds Administration Group supporting the JPMorgan mutual funds and alternative products. Prior to joining the firm, Stephen held a number of positions in Prudential Financial’s asset management business, including assistant general counsel, tax director, and co-head of Funds Administration. Stephen was formerly a tax senior manager with Price Waterhouse (New York) and an associate attorney with Dietrick & Carter PC. He holds a B.A. in English from the University of Virginia, a J.D. from the University of Richmond School of Law, and an LL.M. in tax law from New York University School of Law. Stephen also holds Series 7 and 66 licenses. He is a member of the state bar in New York and Virginia, and a Certified Public Accountant.

6

Description of the Current Investment Management Agreement

As noted above, AllianzGI U.S. currently serves as the investment manager (providing both investment advisory and administrative services) for the Fund pursuant to an Investment Management Agreement, dated as of April 11, 2007, and amended and restated as of April 1, 2013, between AllianzGI U.S. and the Fund (the “Current IMA”). The Board and the Directors of the Fund who are not “interested persons”, as defined in the Investment Company Act of 1940, as amended, and the rules and regulations thereunder (the “1940 Act”), of the Fund, AllianzGI U.S. or JPMorgan Asia (the “Independent Directors”), most recently approved the continuation of the Current IMA on October 24, 2019 for a one-year period ending December 31, 2020. The Current IMA was last submitted the Fund’s Stockholders for approval at a meeting held on April 11, 2007 (at which point the Fund’s investment manager was RCM Capital Management LLC, which subsequently merged into AllianzGI U.S. on April 1, 2013).

Services. Under the terms of the Current IMA, AllianzGI U.S., subject to the supervision of the Board, is obligated to furnish continuously an investment program for the Fund, to make investment decisions on behalf of the Fund, to place all orders for the purchase and sale of portfolio securities, and to provide administrative services reasonably necessary for the operation of the Fund, including but not limited to furnishing office space and equipment, providing bookkeeping and clerical services (excluding determination of net asset value and Stockholder accounting services) and paying all salaries, fees and expenses of the officers and Directors of the Fund who are affiliated with AllianzGI U.S.

Compensation. As compensation for AllianzGI U.S.’s services rendered, and for the facilities furnished and for the expenses borne by AllianzGI U.S., the Fund pays AllianzGI U.S. a management fee under the Current IMA at the following annual percentage rates, based on the average daily net asset value of the Fund:

Annual Management Fee Rate Under the Current IMA

(based on the average daily net assets of the Fund)

| 0.750 |

| ||||||

| 0.725 | % | ||||||

Next $250 million | 0.700 | % | ||||||

Next $250 million | 0.675 | % | ||||||

Amounts in excess of | 0.650 | % |

In addition to the investment management fees paid by the Fund under its Current IMA as described above, the Fund currently directly bears expenses for other administrative services and costs outside of its Current IMA, including expenses associated with various third-party service providers, such as audit, custodial, legal, transfer agency, printing and other services required by the Fund. The fees and expenses for these services are currently included in the Fund’s total expenses and are borne by the Fund’s Stockholders.

Term/Termination/Amendment. The Current IMA took full force and effect for an initial two-year period, and has been subject thereafter to annual approval in accordance with the 1940 Act (i.e., approval by the Board of Directors, or a majority of the Fund’s outstanding voting securities and, in either event, by the vote cast in person by a majority of the Independent Directors). The Current IMA can also be terminated without penalty at any time (i) by the Fund (either by vote of a majority of the Fund’s outstanding voting securities or by vote of a majority of Directors); or (ii) by AllianzGI U.S., in each case on 60 days’ written notice delivered to the other party. Additionally, the Current IMA terminates automatically in the event of its assignment (as defined in the 1940 Act). The Current IMA may not be materially amended unless such material amendment is approved at a meeting by the affirmative vote of a majority of the outstanding voting securities of the Fund, and by the vote, cast in person at a meeting called for the purpose of voting on such approval, of a majority of the Independent Directors of the Fund.

7

As noted above, the current term of the Current IMA expires on December 31, 2020. If the Proposal is approved, the Current IMA will terminate in connection with the anticipated effectiveness of the Proposed Investment Advisory Agreement. If Stockholders do not approve the Proposed Investment Advisory Agreement, the Directors will take such further action as they deem to be in the best interests of the Fund and Stockholders.

Standard of Care/Liability. The Current IMA provides that, in the absence of willful misfeasance, bad faith or gross negligence on the part of AllianzGI U.S., or reckless disregard of its obligations and duties under the Current IMA, AllianzGI U.S., including its officers, directors and partners, will not be subject to any liability to the Fund, or to any Stockholder, officer, partner or Director thereof, for any act or omission in the course of, or in connection with, rendering services under the Current IMA.

Description of the Proposed Investment Advisory Agreement

At a meeting held on November 6, 2020, the Board, including the Independent Directors, unanimously approved, subject to the approval of the Stockholders of the Fund, the Proposed Investment Advisory Agreement between JPMorgan Asia and the Fund, a form of which is attached to this Proxy Statement as Appendix A. The information below summarizes material terms of the Proposed Investment Advisory Agreement and is qualified in its entirely by reference to the form of agreement in Appendix A hereto.

Services. Pursuant to the Proposed Investment Advisory Agreement, subject to the general supervision of the Board, JPMorgan Asia would manage the investment operations of the Fund and determine the composition of the Fund’s holdings of securities and investments, including cash, the purchase, retention and disposition thereof and agreements relating thereto, all in accordance with the Fund’s stated investment objectives and policies. In doing so, JPMorgan Asia would furnish a continuous investment program for the Fund and determine from time to time what investments or securities will be purchased, retained, sold or lent by the Fund, and what portion of the assets will be invested or held uninvested as cash, and would effect the Fund’s portfolio transactions. JPMorgan Asia would also report to the Board as to its services on behalf of the Fund, maintain required books and records with respect to the Fund’s investments, and exercise or procure the exercise of any voting rights attaching to the Fund’s investments or any rights of the Fund with respect to class action proceedings or other corporate or legal actions concerning the Fund’s investments. Pursuant to the Proposed Investment Advisory Agreement, JPMorgan Asia would assumes and pay for maintaining its staff and personnel and, at its own expense, provide the equipment, office space, office supplies, and facilities necessary to perform its obligations under the Agreement.

Compensation. Under the Proposed Investment Advisory Agreement, as compensation for JPMorgan Asia’s services rendered, and for the facilities furnished and for the expenses borne by JPMorgan Asia, the Fund would pay JPMorgan Asia a fee at the following annual percentage rates, based on the average daily net asset value of the Fund:

Annual Management Fee Rate Under the Proposed Investment Advisory Agreement

(based on the average daily net assets of the Fund)

| 0.700 | % | ||||||

| 0.650 | % | ||||||

|

Transactions withTerm/Termination/Amendment. The Proposed Investment Advisory Agreement, if approved by Stockholders, will remain in full force and Remuneration of Directors and Officers

The Board’s remuneration policy is to emphasize commitmenteffect as to the Fund, involvement in Fund issues and attendance by Directors at Board meetings. Directors receive an annual retainer fee of $20,000, except the Chairman of the Board, who receives an additional $17,000 annual retainer fee. Each Independent Director receives a fee, paid by the Fund, of $5,000 per Directors’ meeting attended and of $1,000 per telephonic Directors’ meeting attended. The Chairman of the Audit and Compliance Committee receives an additional $10,000 annual feeunless sooner terminated as described below, for serving in that capacity. Each Independent Director also receives $10,000 annual maximum remuneration for attendance at Audit and Compliance Committee meetings (depending on the number of meetings) and $5,000 per Contracts Committee meeting attended (there is a $5,000 annual maximum remuneration for attendance at Contracts Committee meetings).

In addition, each Independent Director is eligible to receive a per diem fee for a full day of $2,000 or apro-rated fee for a lesser period as compensation for

108

takingan initial two-year period, and shall continue thereafter on special assignments. Such special assignments must bean annual basis provided that continuance is specifically approved in advanceat least annually (i) by either the Governance, Nominating and Remuneration Committee, except that special assignments for which compensation will be less than $5,000 may be approved in advance by the ChairmanDirectors or a vote of the Governance, Nominatingmajority of the outstanding voting securities (as defined in the 1940 Act) of the Fund; and Remuneration Committee. A report regarding compensation(ii) by a majority of the Independent Directors by vote cast in person at a meeting called for such assignments is provided topurpose (or otherwise, as consistent with applicable laws, regulations and related guidance and relief). The Proposed Investment Advisory Agreement may also be terminated at any time, without the Governance, Nominating and Remuneration Committee at its next regular meeting.

The Manager supervisespayment of any penalty, by vote of a majority of all the Fund’s investments, pays the compensation and certain expenses of its personnel who serve as officers of the Fund, and receives a management fee for its services. The Fund’s other officers are also officers, employees, or stockholders of the Manager’s affiliates and are paid a compensation by those firms. The Fund makes no direct payments to its officers.

The following Compensation Table provides the aggregate compensation received by each Director from the Fund for the fiscal year ended June 30, 2018. For the calendar year ended December 31, 2017, the Directors and the nominee received the compensation set forth in the table below for serving as Directors of the Fund and other funds inor by the same “fund complex” as the Fund. Noneaffirmative vote of a majority of the Directors serves on any other registered investment company in the fund complex advised by the Manager and its affiliates. The Fund does not pay retirement benefits to its Directors.

Compensation Table

Independent Director/Nominee | Aggregate Compensation from the Fund for the Fiscal Year Ended June 30, 2018 | Total Compensation from the Fund and Fund Complex* Paid to Directors/Nominee for the Calendar Year Ended December 31, 2017 | ||||||

Christopher B. Brader | $ | 55,000 | $ | 60,000 | ||||

Joseph T. Grause, Jr | $ | 55,000 | $ | 58,000 | ||||

Julian Reid | $ | 72,000 | $ | 75,000 | ||||

Richard A. Silver | $ | 65,000 | $ | 68,000 | ||||

|

Each of the Fund’s executive officers is an interested person of the Fund as a result of his or her position set forth in the table above.

11

Director Qualifications— The Board has determined that Messrs. Brader, Grause, Reid and Silver should continue to serve as Directors based on several factors (none of which alone is decisive). Each Director is familiar with the Fund’s business and service provider arrangements. Among the factors the Board considered when concluding that the continuing Directors and the Director nominee should serve on the Board were the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s ability to work effectively with other members of the Board; (iii) the individual’s prior experience, if any, serving on the boards of public companies (including, when relevant, other investment companies) and other complex enterprises and organizations; and (iv) how the individual’s skills, experiences and attributes would contribute to an appropriate mix of relevant skills and experience on the Board.

In respect of each current Director and the Director nominee, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Fund, were a significant factor in the determination that the individual should serve as a Director of the Fund. Following is a summary of various qualifications, experiences and skills of each Director (in addition to business experience during the past five years set forth in the table above) that contributed to the Board’s conclusion that an individual should serve on the Board:

Julian Reid— Mr. Reid has more than 30 years of U.S. andnon-U.S.closed-end fund experience, including, among other things, serving as the head of theclosed-end fund business for Jardine Fleming Investment Management (at the time, a leading investment management company in Asia, subsequently acquired by JP Morgan) and as the chairman and/or a director of numerousclosed-end funds. He has spent over 40 years in the financial services industry spanning Europe, Asia and the Americas. He was based in Asia for approximately 25 years, and during that time, spent time focusing on, among others, the Korean stock market. He is an Affiliate of the Securities Industry of Australia and has been licensed by the respective regulatory bodies in the United Kingdom, Hong Kong, Singapore and Australia. In 2007, Mr. Reid was named “Small Board Trustee of the Year” by Fund Directions, a U.S. magazine focusing on corporate governance matters, for his work as the independent chairman of the Fund. Mr. Reid currently serves as an Independent Director of The China Fund, Inc.

Richard A. Silver— Mr. Silver has more than 30 years of senior executive experience in the investment management industry. He served as treasurer and chief financial officer (for three years) of all Fidelity Mutual Funds and as executive vice president (for five years) of Fidelity Investments, during which

12

time he oversaw accounting, financial reporting and related operations for more than 400 mutual funds and 2,300 other investment portfolios. He also served as senior vice president, treasurer and chief financial officer of The Colonial Group, Inc. for nearly 19 years, heading the company’s financial services group. In addition, Mr. Silver served as the chairman of the Accounting/Treasurers’ Committee of the Investment Company Institute for approximately seven years. Mr. Silver currently serves as an Independent Director of The China Fund, Inc.

Joseph T. Grause, Jr. —Mr. Grause has more than 30 years of senior executive experience in the investment management industry. He previously served as Director of International Investment Consulting for Morningstar Associates Europe Limited (for three years) and as Chief Executive Officer of Morningstar UK and Morningstar France (for two years). Between 1993 and 2002, Mr. Grause held senior executive positions at AdvisorCentral, American General Asset Management, Cypress Holding Company and First Data Corporation. Prior to 1993, Mr. Grause was a Senior Vice President at Fidelity Investments, where he spent the first 17 years of his investment management career. In addition, Mr. Grause currently serves as Independent Trustee of the Advisors’ Inner Circle, Advisors’ Inner Circle II and Bishop Street Funds.

Christopher B. Brader— Mr. Brader has more than 40 years of investment management experience in emerging markets, with over a decade spent working with investment funds. He was an Investment Consultant at Advance Emerging Capital for ten years, where he was responsible for Asian investments and macro coverage. Mr. Brader was previously affiliated with ING Barings Securities Ltd., where he ran the emerging marketsclosed-end fund team from 1994 to 2002. Prior to that, he spent ten years at Cazenove & Co. in Hong Kong and Japan. In addition, Mr. Brader currently serves as a Director of LIM Japan Fund, Director of India Capital Management, Ltd., Director of Long Investment Management (Cayman) Limited, Director of LIM Marketing Services Limited, and Director of Long Investment Management International Ltd.

Committees of the Board of Directors

Audit and Compliance Committee.The Fund’s Audit and Compliance Committee is currently composed of all of the Directors, each of whom is not an “interested person”outstanding voting securities (as defined in the 1940 Act) of the Fund (collectively,on 60 days’ written notice to JPMorgan Asia, or by JPMorgan Asia at any time, without the “Independent Directors”)payment of any penalty, on 90 days’ written notice to the Fund. The Proposed Investment Advisory Agreement would automatically and is chaired by Mr. Silver. The membersimmediately terminate in the event of the Audit and Compliance Committee are independent, as independence isits “assignment” (as defined in the listing standards1940 Act).

Standard or Care/Liability. The Proposed Investment Advisory Agreement provides that JPMorgan Asia shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund in connection with the matters to which the Agreement relates, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services (in which case any award of damages shall be limited to the period and the amount set forth in Section 36(b)(3) of the NYSE applicable1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence on JPMorgan Asia’s part in the performance of its duties or from reckless disregard by it of its obligations and duties under the Agreement.

Effective Date. If the Proposed Investment Advisory Agreement is approved by the Fund’s Stockholders, it will take effect concurrent with the termination of the Current IMA. The current term of the Current IMA expires on December 31, 2020. The actual effective date of the Proposed Investment Advisory Agreement will be at a date and time mutually agreeable to the Fund, JPMorgan Asia and AllianzGI U.S. in order to effect an efficient transition for the Fund and Stockholders.

Comparison of Fees and Expenses under the Current IMA and the Proposed Investment Advisory Agreement.

As described above, following the Transition and pursuant to the Proposed Investment Advisory Agreement and Other JPMorgan Agreements, JPMorgan Asia and other JPMorgan Entities would collectively provide all of the investment advisory and administrative services for the Fund currently provided or procured by AllianzGI U.S. under the Current IMA, and JPMorgan Chase would provide the custody services to the Fund currently provided by State Street in its capacity as the Fund’s current custodian.

The proposed advisory fees payable under the Proposed Investment Advisory Agreement are described above. The Board has also approved a Fee Agreement with JPMorgan setting forth fees and expenses to be paid or reimbursed to JPMorgan Chase for fund accounting and custody services under the Fund Administrative Services Agreement and Global Custody Agreement. JPMFL is not entitled to any compensation or reimbursement from the Fund under its contemplated Services Agreement with the Fund, and will be compensated or reimbursed by JPMorgan Asia for its services pursuant to a JPMorgan intercompany arrangement. The Board also approved a proposed expense limitation arrangement (the “Expense Limitation”) pursuant to which JPMorgan Asia would agree to waive a portion of its investment advisory fee and/or pay expenses of the Fund such that, for a three-year period following the effectiveness of the Proposed Investment Advisory Agreement, the Fund’s fees and expenses (i) for administrative services currently provided by AllianzGI U.S. under the Current IMA would not exceed $78,000 per annum and (ii) for fund accounting services currently provided or procured by AllianzGI under the Current IMA would not exceed $20,000 per annum. The Fund would separately pay or reimburse fees and expense to JPMorgan Chase for custody and related services under the Global Custody Agreement in accordance with the Fee Agreement and outside of the Expense Limitation.

9

The tables below set forth the total annual expenses incurred by the Fund during its most recent fiscal year ended June 30, 2020 and estimates of the pro forma total annual expenses that the Fund would have incurred during the same period if the Proposed Investment Advisory Agreement and Other JPMorgan Agreements (before and after taking into account the Expense Limitation) had been in effect, and the Fund’s asset levels remained the same.

ANNUAL EXPENSES AND PRO FORMA ANNUAL EXPENSES

(expressed as a percentage of net assets attributable to Common Shares)

| Under Current IMA | ||||

Management Fees (advisory and administrative) | 0.75 | % | ||

Other Expenses | [●] | % | ||

Total Annual Expenses | [●] | % | ||

| Estimated Pro Forma Under Proposed Investment Advisory Agreement | ||||

Advisory Fees | 0.70 | % | ||

Administrative Fees* | [●] | % | ||

Other Expenses** | [●] | % | ||

Total Annual Expenses | [●] | % | ||

(Expense Reduction/Fee Waiver)*** | [(●)] | % | ||

Total Annual Expenses After Expense Reduction/Fee Waiver | [●] | % | ||

| * | Includes fees and expenses payable by the Fund under the contemplated Fund Administrative Services Agreement between the Fund and JPMorgan Chase in accordance with the Fee Agreement. |

| ** | Includes, among other expenses, fees and expenses payable by the Fund to JPMorgan Chase under the contemplated Global Custody Agreement in accordance with the Fee Agreement. |

| *** | Reflects the contemplated Expense Limitation, pursuant to which JPMorgan Asia would agree to waive a portion of its investment advisory fee and/or pay expenses of the Fund such that, for a three-year period, the Fund’s fees and expenses (i) for administrative services currently provided by AllianzGI U.S. under the Current IMA would not exceed $78,000 per annum and (ii) for fund accounting services currently provided or procured by AllianzGI under the Current IMA would not exceed $20,000 per annum. |

The Board’s Consideration of the Proposed Investment Advisory Agreement

The 1940 Act requires that the Board and a majority of the Independent Directors, voting separately, approve the Proposed Investment Advisory Agreement with JPMorgan Asia on behalf of the Fund (as used in this section, the “Agreement”). The Fund’s Board is comprised of three Directors, all of whom are Independent Directors. At a video/telephonic meeting1 held on November 6, 2020, the Board approved the Proposed Investment Advisory Agreement at the recommendation of the Board’s Contracts Committee, which is comprised of all three Independent Directors. Throughout the Board’s process for reviewing the Agreement, the Independent Directors received legal advice from legal counsel that is experienced in 1940 Act matters, and with whom they met separately throughout the process.

| 1 | The Board and the Independent Directors determined to rely on the relief granted by an order issued by the U.S. Securities and Exchange Commission (the “SEC”) that permits fund boards of directors to approve advisory contracts at a meeting held remotely rather than in-person in response to the impact of COVID-19 on investment advisers and funds. |

10

The Directors believe that AllianzGI U.S. has served the Fund well for many years. However, AllianzGI U.S. announced earlier this year (in July 2020) its intention to transition away from the business of serving as sponsor/administrator of U.S. registered open- and closed-end funds.funds on or about the end of calendar 2020. Upon learning of this development, the Fund’s Board conducted a search process which involved consideration of and interviews with several large asset management firms with experience managing investment vehicles that focus on Korean equity securities such as the Fund, and closed-end funds in particular. Following completion of the search process, on August 28, 2020, the Fund announced that it had determined to pursue arrangements with JPMorgan Asia and its affiliates to replace AllianzGI U.S. as investment adviser and administrator to the Fund.

The AuditFollowing negotiations with JPMorgan regarding the terms and arrangements under the proposed Investment Advisory Agreement and the Other JPMorgan Agreements, the Directors provided a written request for information from JPMorgan Asia and other applicable JPMorgan Entities to provide all information as may reasonably be necessary for the Directors to evaluate the terms of the Proposed Investment Advisory Agreement and other applicable proposed arrangements in connection with the Transition. In response to this request, the Board received and relied upon materials provided by JPMorgan Asia and other JPMorgan Entities, which included, among other items:

(i) information regarding the Korean equity investment strategy and approach to be used by JPMorgan Asia in managing the Fund’s portfolio, including information regarding JPMorgan’s clients and assets under management with a similar investment strategy;

(ii) information regarding the background and qualifications the portfolio managers and other personnel at JPMorgan Asia who would provide investment management, research, portfolio trading and other asset management services on behalf of the Fund and related technologies and systems in place at JPMorgan Asia;

(iii) information regarding how the Korean equity strategy to be used by JPMorgan Asia in managing the Fund’s portfolio differs from the approach used by AllianzGI U.S., including estimates of anticipated portfolio turnover in connection with the Transition;

(iv) information regarding the overall organization of JPMorgan Asia and other applicable JPMorgan Entities (including JPMorgan Chase and JPMFL), including information regarding clients and assets under management, financial resources and results, and senior management and other personnel who would provide administrative, fund accounting, legal, compliance, custody and other services to the Fund, including the current Form ADV of JPMorgan Asia and the most recent audit financial statements of JPMorgan Asia’s parent company, JPMorgan Chase & Co., and a recent balance sheet of JPMorgan Asia;

(v) information compiled from Morningstar regarding the investment performance of JPMorgan funds and accounts that focus on Korean equity securities for various time periods ended August 31, 2020 in comparison to the investment performance of the Fund and a comparative peer group of funds and an applicable benchmark index;

(vi) information compiled from Morningstar regarding the proposed investment management fees and estimated total annual expenses of the Fund under the Proposed Investment Advisory Agreement and other contemplated arrangements with JPMorgan in comparison to the Fund’s current fees and expenses with AllianzGI U.S. as investment manager and with the fees and expenses of a comparative peer group of funds;

(vii) information regarding the investment management fees and expenses of comparable funds and accounts managed by JPMorgan Asia with a Korean equity focus;

11

(viii) information regarding the estimated annual profitability to JPMorgan Asia from its relationship with the Fund under the Proposed Investment Advisory Agreement and other arrangements with JPMorgan;

(ix) descriptions of various administrative, compliance, legal, fund accounting, vendor oversight and other services to be provided to the Fund by JPMorgan Entities following the Transition and the related experience of the JPMorgan Entities in these areas, and the experience and qualifications of JPMorgan personnel who will be responsible for providing such services, including personnel who will be proposed to serve as the Fund’s principal executive officers (including President, Treasurer, Chief Compliance Committee’s purposes are: (i)Officer and Chief Legal Officer) following the Transition;

(x) descriptions of the compliance policies and program of JPMorgan Asia and other JPMorgan Entities that will be applied and implemented for the Fund, including those relating to potential conflicts of interest;

(xi) descriptions of the various programs in place at JPMorgan Asia and otherwise at JPMorgan to oversee and manage various categories of investment, operational, business and strategic and other risks, including with respect to business continuity and disaster recovery and cybersecurity and data security risks;

(xii) a description of any “fall-out” benefits that JPMorgan may realize as a result of its relationship with the integrityFund; and

(xiii) information regarding potential economies of scale that JPMorgan Asia may experience in its management of the Fund.

Following receipt of the requested information, the Board and its Contracts Committee participated in several telephone calls and video meetings with their counsel and with representatives from JPMorgan and AllianzGI US. to review and discuss the materials provided and the prosed arrangements, which included meetings of the Contracts Committee and the Board on October 22, 2020, and additional meetings of the Contracts Committee and Board on November 6, 2020 at which the Board approved the Proposed Investment Advisory Agreement and related arrangements (together, the “Review Meetings”).

During the course of the Review Meetings, the Directors examined the abilities of JPMorgan Asia and other JPMorgan Entities to provide high-quality investment advisory, administrative and other services to the Fund in replacement of AllianzGI U.S. Among other information, the Trustees considered the investment philosophy and research and decision-making processes to be employed by JPMorgan Asia; the experience of key advisory personnel of JPMorgan Asia who would be responsible for portfolio management and trading for the Fund; the ability of JPMorgan Asia to attract and retain capable personnel; and the capabilities of the senior management and staff of JPMorgan Asia and other JPMorgan Entities who will provide services to the Fund, including those who will be proposed to serve as officers of the Fund. In addition, the Directors considered the quality of services to be provided by JPMorgan Asia and other JPMorgan Entities with respect to regulatory compliance and compliance with the investment policies and restrictions of the Fund; the nature and quality of the supervisory and administrative services that JPMFL will be responsible for providing to or procuring for the Fund; and conditions that might affect the abilities JPMorgan Asia or other JPMorgan Entities to provide high-quality services to the Fund under the Proposed Investment Advisory Agreement and Other JPMorgan Agreements. These included JPMorgan’s financial condition and operational stability, and any anticipated investment or personnel resource or capacity constraints associated with JPMorgan’s taking the Fund on as a new client.

Among other information, the Directors reviewed information showing the total return/net asset value investment performance of JPMorgan funds and accounts that focus on Korean equity securities for various time periods ended August 31, 2020 in comparison to the investment performance of the Fund and a comparative peer

12

group of funds and an applicable benchmark index, and noted that the performance results of JPMorgan Asia in the Korean equity strategy generally compared favorably for the periods show, particularly during the three- and five-year periods.

Based on the foregoing and other considerations, the Directors concluded that JPMorgan Asia’s investment process, research capabilities and philosophy were well suited to the Fund given its investment objective and policies, and that JPMorgan Asia and other JPMorgan Entities would be able to meet any reasonably foreseeable obligations under the Proposed Investment Advisory Agreement and Other JPMorgan Agreements following the Transition. The Directors also determined to adopt a conditional performance-based tender offer policy for the Fund as a means to monitor the Fund’s performance and signal potential action in the event of underperformance following the Transition. See “Conditional Performance-Based Tender Offer Policy” below.

In assessing the reasonableness of the proposed fees under the Proposed Investment Advisory Agreement, the Directors considered, among other information, the proposed annual advisory fee rate payable to JPMorgan Asia of 0.70% of the Fund’s financial statements,average daily net assets up to $250 million is lower than the Fund’s current investment management fee of 0.75% up to the $250 million breakpoint under the Current IMA. They also took into account that the Current IMA covers administrative and fund accounting services that will not be provided under the Proposed Investment Management Agreement, but that JPMFL and JPMorgan Chase will provide such services to the Fund pursuant to the Other JPMorgan Agreements. In this regard, the Directors took into account the proposed Fee Agreement with respect to the Other JPMorgan Agreements, together with JPMorgan Asia’s agreement to observe the Expense Limitation, such that the Fund’s fees and expenses for administrative and fund accounting services currently provided by AllianzGI U.S. will not exceed $78,000 and $20,000, respectively, for a three-year period. The Directors noted that, as a result of these proposed arrangements, the Fund’s estimated total annual expense ratio (after taking into account the Expense Limitation) with JPMorgan following the Transition is anticipated to be [somewhat] lower than the Fund’s current total expense ratio with AllianzGI U.S. as investment manager under the Current IMA. In addition, the Directors took into account information comparing the Fund’s proposed fees and estimated total expenses with the investment management fees and total expense ratios of a comparable peer group of funds based on information provided by Morningstar, which indicated that the Fund’s estimated advisory fees and total expenses following the Transition would be below average and on the low end of the range of fees and expenses of the peer funds. The Directors also took into account information regarding the management fees charged by JPMorgan Asia to comparable funds and accounts it manages (none of which are U.S. registered closed-end funds), but in doing so considered that these comparisons may not be particularly apt in light of differences in levels of investment management and administrative services, operations, regulatory and compliance burdens and other factors differentiating the Fund from other types of funds or accounts.

The Directs also considered an estimated annual profitability analyses provided by JPMorgan Asia with legalrespect to its relationship with the Fund, including descriptions of the methodologies and assumptions used by JPMorgan Asia in estimating profitability. Based on the information provided, the Directors determined, taking into account the various assumptions made, that such estimated profitability did not appear to be excessive.

The Directors also took into account the entrepreneurial and business risk that JPMorgan will be subject to by assuming the role of investment manager of the Fund.

The Directors also considered the extent to which JPMorgan may realize economies of scale or other efficiencies in managing and supporting the Fund following the Transition. The Directors noted that, as a listed closed-end fund, it is not currently anticipated that the Fund will raise additional assets or otherwise grow in size other than through investment gains. However, the Directors took into account that the Proposed Advisory Agreement imposes a fee waiver/breakpoint from 0.70% to 0.65% on the Fund’s average daily net assets in excess of $250 million, which would serve as a means of partially sharing economies of scale or efficiencies gained by JPMorgan Asia through asset growth above this level with Fund shareholders.

13

Additionally, the Independent Trustees considered so-called “fall-out benefits” to JPMorgan from JPMorgan Asia’s relationship as investment adviser to the Fund, such as research, statistical and regulatory requirements,quotation services, if any, the qualificationsfirm may receive from broker-dealers executing the Fund’s portfolio transactions or reputational value derived from serving as investment adviser to the Fund. They also considered the compensation and independenceother benefits to be received by other JPMorgan Entities, including JPMFL and JPMorgan Chase, for providing administrative, fund accounting, custody and other services to the Fund pursuant to the Other JPMorgan Agreements as described above.